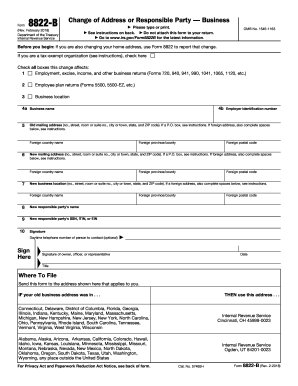

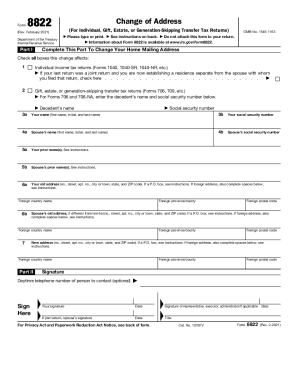

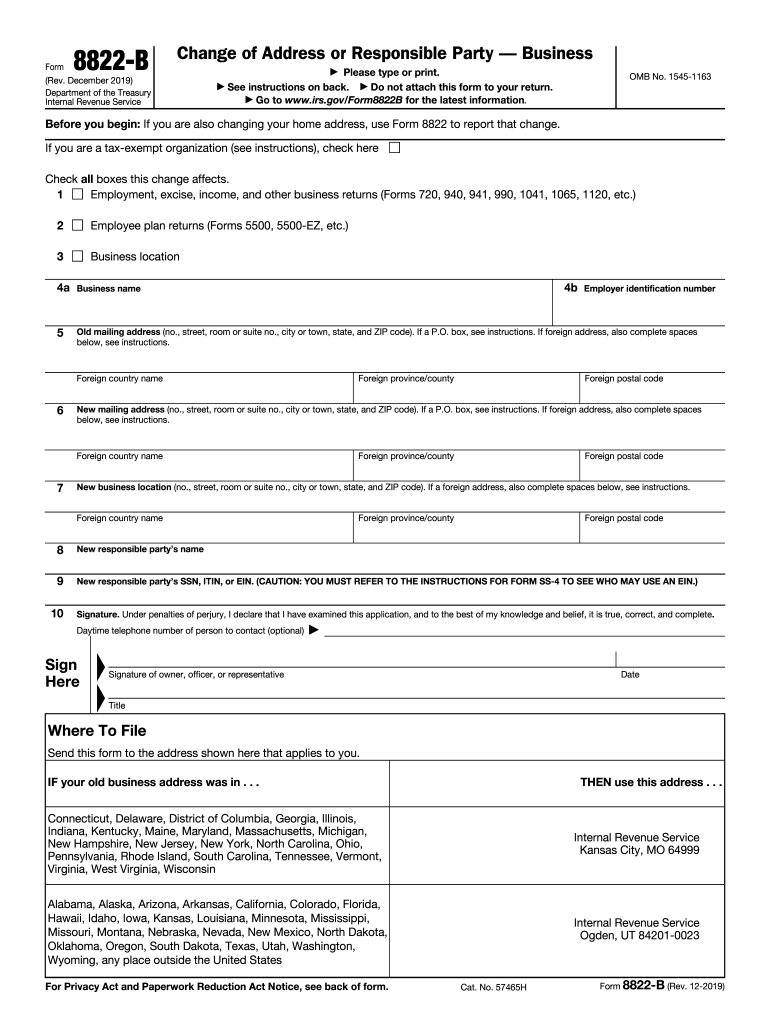

IRS 8822-B 2019-2026 free printable template

Instructions and Help about IRS 8822-B

How to edit IRS 8822-B

How to fill out IRS 8822-B

Latest updates to IRS 8822-B

All You Need to Know About IRS 8822-B

What is IRS 8822-B?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8822-B

What should I do if I realize I've made a mistake after filing IRS 8822-B?

If you discover an error after submitting IRS 8822-B, you can correct it by submitting an amended form. Ensure that you clearly indicate the changes made, and consider providing an explanation if necessary. Retaining copies of your original and amended forms is crucial for your records.

How can I confirm that the IRS has received my IRS 8822-B?

To verify the receipt of your IRS 8822-B, you can contact the IRS directly. Additionally, if you e-filed, you may receive a confirmation email. Tracking the status might help you ensure that your form is being processed. Keep your confirmation details handy for reference.

Are electronic signatures acceptable when filing IRS 8822-B?

Yes, the IRS accepts e-signatures for IRS 8822-B when filed electronically, provided that you meet the specific requirements set forth by the agency. Make sure to follow the outlined guidelines to ensure the legitimacy of your submission.

What should I do if my IRS 8822-B is rejected when e-filing?

If your e-filed IRS 8822-B is rejected, review the rejection code provided by the IRS to determine the cause. Common issues may include incorrect information or formatting errors. Resolve the identified issues and resubmit the form promptly to avoid delays.

What are common errors to avoid when submitting IRS 8822-B?

When filing IRS 8822-B, common errors include providing incorrect taxpayer identification numbers, misreporting addresses, or failing to sign the form. To minimize mistakes, double-check all entries for accuracy and completeness. This diligence can help prevent processing delays.

See what our users say