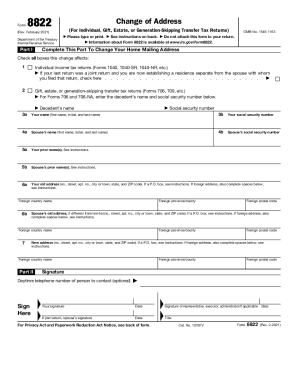

What is form 8822-B?

Business entities and taxpayers must file form 8822-B to notify the United States Internal Revenue Service about a change of their business mailing address, business location, or the identity of their responsible party. The full name of the 8822-B form is Change of Address or Responsible Party — Business.

Who should file IRS form 8822-B?

A business that changes its mailing address, business location, or the identity of its responsible party should file the form.

What information do you need when you file form 8822-B?

It is required to provide the following details:

- Business name

- EIN (Employer Identification Number)

- Old mailing address

- New mailing address

- New location of a business

- New responsible party’s name and SSN, ITIN, or EIN

- Signature

How do I fill out form 8822-B in 2025?

First, indicate in form 8822-B whether the submitter is a tax-exempt organization. The next part of the form is a checkbox asking about the possible effects the change may have (employment, income, employee return plan, business location, etc.).

You can also find detailed 8822-B form instructions on Page 2 of the form.

Complete form 8822-B online in a few minutes with pdfFiller:

- Click Get Form to open the 8822-B form in pdfFiller.

- Fill out and sign the form.

- Click Done and Send via USPS.

- Fill in the mailing information.

- Select a delivery method.

- Click the Send button.

The form will be printed and promptly delivered to the post office by pdfFiller.

Is form 8822-B accompanied by other forms?

No other forms are required to submit with form 8822-B. However, if the taxpayer’s representative is filing the IRS change of address form 8822-B for the taxpayer, a copy of the taxpayer’s power of attorney must be provided as an attachment.

When is form 8822-B due?

Filing the 8822-B form is required within 60 days of the change in any of the following: Business Mailing Address, Principal Place of Business, Name/Title of the Responsible Party. Typically, the Address or Responsible Party Change Form process takes up to 6 weeks.

Where do I send form 8822-B?

Send the IRS form 8822-B to Internal Revenue Service Kansas City, MO 64999 if the business’s old address is in one of the following states: Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin.

Send the form to Internal Revenue Service Ogden, UT 84201-0023 if the business’s old address is in one of the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming, any place outside the United States.